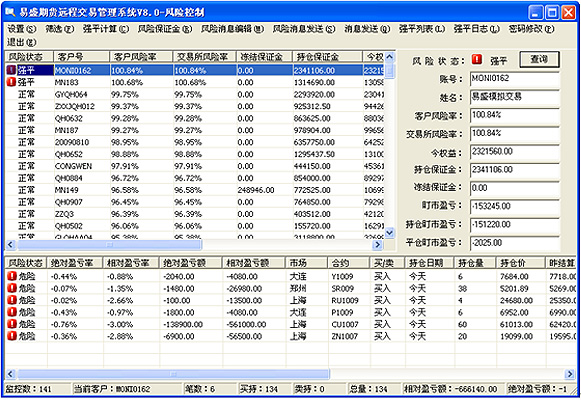

As an ordering software system on the domestic futures market, the trading and management system for domestic futures is designed and gradually improved by Esunny through years of continuous research and development, which satisfies various needs of most domestic futures investors in the current market for trading system and observes the latest business rules of the four futures exchanges in China. It reduced the redundancy and complexity of the management of the trading system, in order to makes our trading system fast, stable, secure and easy to operate.

This system is open to all institutional and individual investors, who are involved in domestic futures trade, and suitable to be installed in futures commission merchants and investment institutions engaging in domestic futures trade.The main functions and features are as follows:

1) Support trading of commodity futures and financial futures, combination order and calendar spread arbitrage, support different kinds of order like conditional order, pre-placed order, automatic order, support business requirements of such as exchanges switch, stop-loss & take profit, hedging, etc.

2) Support margin parameter setting according to the price difference with standards of the customer and the exchange, saving the daily workload of system maintainer on margin parameter setting;

3) Support electronic certificates from Shanghai CA center to authorize the customer's identity, this double authentications of hardware and password will guarantee the safety of customer’s futures account;

4) Support customer margin calculation settings, the funds data consistency among the multi-seat systems.

5) Support the calculation of a single margin when an individual customer queries the position, which can be conveniently checked fund for the

futures commission merchant;

6) Support the connection with margin supervision center to obtain the dynamic secret key of bills, which enables customer queries bills directly through the margin supervision center after log in trading system;

7) Support importing margin parameters from third party trading system into the Esunny counter management system;

8) Support the supervision and warning system of abnormal transaction which required by the current exchanges

9) Support Esunny program trading

10) Support the synchronization function of money in & out of the third party’s trading system

11) Multi-connection function added to the counter management system, achieving the synchronizing management among multiple Esunny systems;

12) Support personalized functions such as quick-order, one click to open position,one click to cancel order, one click to close position, rapid exceed price;